Matthew Daniel and Dustin Albright |

Last month, the National Association of Manufacturers’ latest Outlook Survey called out what many in our sector already feel palpably every day: The struggle to attract and retain quality employees. While the headlines of news stories reporting on this challenge often point to generational perceptions or macroeconomic pressures as the culprit, the deeper issue for HR leaders is a strategic one.

Too many talent strategies still rely on a set of outdated assumptions. Among them, that employees have the time, money, and clarity to pursue a degree; that reimbursement models are sufficient to reach the frontline; and that merely offering programs is the same as driving skill development. But the pace of change in industrial work has outstripped these assumptions. Today’s operations require learning that’s fast, focused, and aligned to business needs. Manufacturers who fail to adjust to this reality risk falling behind.

Two companies — Signature Aviation and Lennox — are showing what this new approach could look like. By replacing legacy programs with prepaid tuition, role-specific learning, and data-driven strategy, they’re building stronger pipelines from within and have the ROI to back it up. Their approaches may differ, but their stories surface three key success factors for making education strategy stick — and scale.

Here are the biggest insights shared by Mike Janninck, vice president of Total Rewards at Signature Aviation, and Lindsay Bedard, vice president of talent management at Lennox, during a recent webinar hosted by Guild on the subject.

1. Access that meets the moment

Historically, education benefits were structured around tuition reimbursement and four-year degrees, which served salaried employees but often excluded frontline workers.

As Signature’s Mike Janninck put it, “I had someone getting a bachelor’s degree in forestry. We’re an aviation company. That told me we were missing the mark on what the business really needed.”

Under Jannick’s leadership, Signature shifted toward prepaid tuition, short-form certificates, and more flexible learning options to let workers balance their shift schedules and limited free time. The results were immediate. Between 70–80% of early enrollments came from frontline employees. At Lennox, meanwhile, Bedard’s team focused on removing financial barriers that disproportionately impacted lower-income workers.

“We had employees making under $30,000 a year being asked to front tuition. That wasn’t going to work,” said Lennox’s Lindsay Bedard.

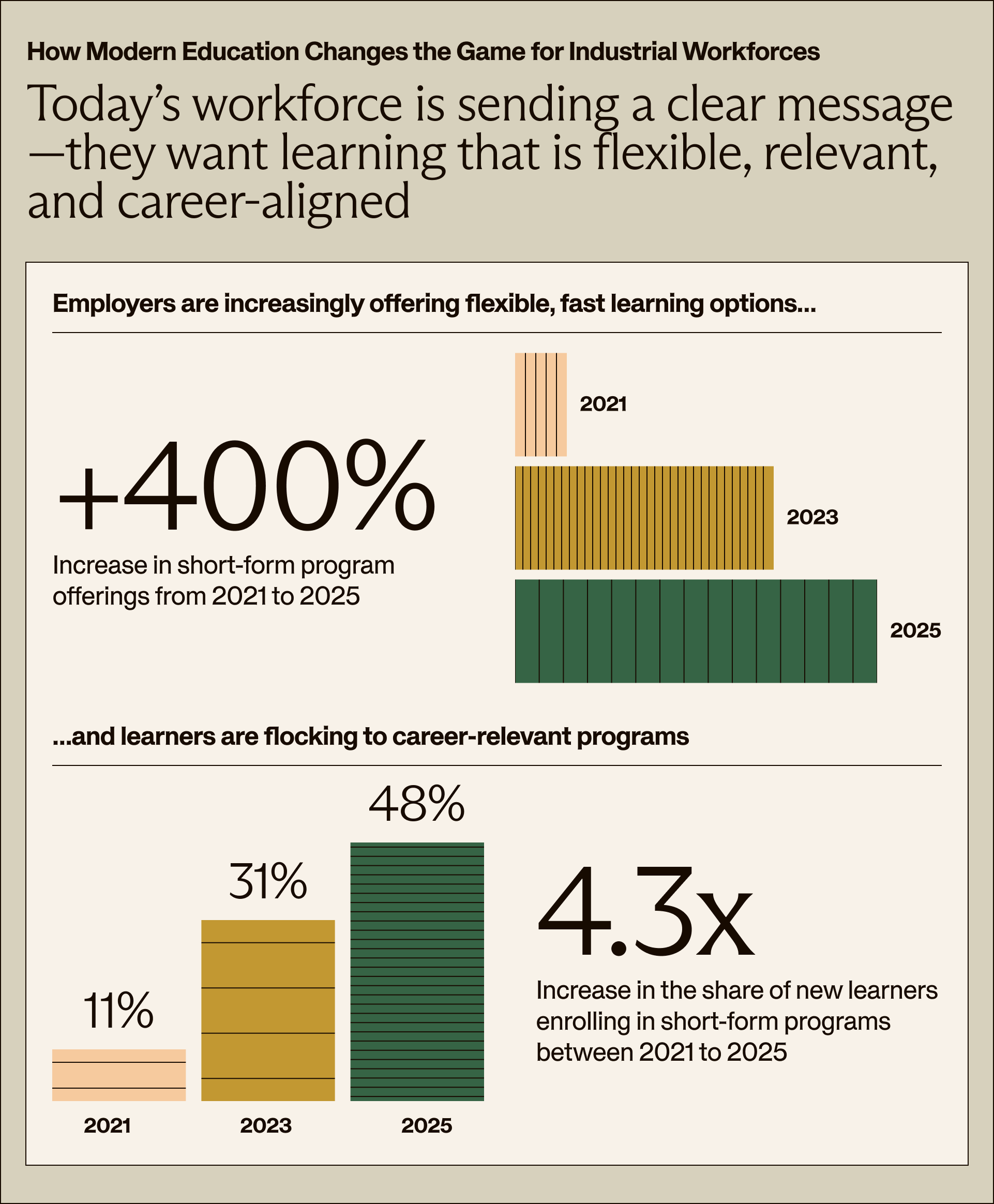

Guild data reflects this growing shift. Between 2021 and 2025, the number of short-form programs offered increased by 400%, while the share of learners enrolling in those programs grew 4.3x.

This change also addresses a deeper pipeline issue. As the workforce ages and Gen Z shows declining interest in industrial careers, manufacturers face a demographic cliff. Guild data shows that learners ages 20–34 make up more than half of all industrial enrollments — nearly double the Bureau of Labor Statistics benchmark. That’s a signal: Younger workers will engage when programs are visible, flexible, and tied to real opportunity.

2. Reach that scales strategically

Once programs are accessible, the next challenge is scale. And not just how many people within an organization engage with learning opportunities, but how those opportunities align with business needs across roles, locations, and functions.

Traditional tuition-reimbursement programs often fail to deliver on this front, engaging just 1–2% of eligible employees. In contrast, high-performing Guild partners in manufacturing and logistics now see 10%+ engagement by tying programs to core business priorities. Guild research confirms this trend across sectors: high-performing CHROs and L&D leaders are over 120% more likely to meet their top business goals when learning is tightly aligned with strategic priorities.

At Signature, Janninck integrated education strategy into a broader conversation about Total Rewards, embedding it alongside healthcare, compensation, and retirement planning. “We take all the things we’re looking at, and I actually expand it beyond benefits,” he explained. “It helped frame the bigger Total Rewards strategy.”

At Lennox, Lindsay Bedard aligned education with the company’s employer value proposition: “Come, stay, and grow with us.” That message was supported by a structured rollout, a curated program catalog, and targeted outreach to frontline teams.

Guild data shows that learners ages 20–34 make up more than half of all industrial enrollments — nearly double the Bureau of Labor Statistics benchmark. That’s a signal: Younger workers will engage when programs are visible, flexible, and tied to real opportunity.

What both leaders recognized — and made visible to their C-suite peers — is that talent strategy is a matter of operational sustainability. Without dependable talent pipelines, the business cannot scale. And in critical roles, it may not even survive.

Janninck put it bluntly: “We don’t have enough mechanics … We can go buy them, but it's a pricey proposition. So let’s build our own.”

This shift from episodic L&D to long-term workforce investment is what allows programs to scale with intent. When education strategy becomes business strategy, engagement follows.

3. Relevance that drives retention

The most effective talent strategies enable people to acquire skills that matter on the job. At both Signature and Lennox, employees are enrolling in programs that tie directly to the roles they’re in now or the roles they want next.

Bedard pointed out that only 20 hourly employees had taken advantage of tuition- reimbursement benefits since 2020. With a refreshed strategy, Lennox expects that number to grow rapidly and will be tracking promotion rates and internal mobility closely as measures of success.

Guild’s broader data shows that learners are prioritizing growth within their current function, not just using education to make a lateral move. At two large industrial employers, 75–95% of learners enrolled in certificates and bootcamps that built on their existing skill sets — programs tied to how industrial work is evolving, from the digitization of operations to the rise of data-informed frontline roles.

As Jannick summed it up, “this is survivability of a large segment of our business.”