Brendan Farley |

The “One Big Beautiful Bill Act” (OBBBA) marks a sweeping overhaul of federal student aid and repayment policy. With new repayment plans, borrowing caps, and wage-garnishment rules, the legislation will reshape the financial lives of millions of workers — and redefine how employers support them.

While federal student loan policy has always impacted employees, HR’s role has largely remained on the sidelines. The OBBBA changes that. It presents an opportunity for HR leaders to reduce financial stress and build trust with employees. These policies may be federal, but their effects will be felt locally — in paychecks, productivity, and the lived experience of your workforce.

This article breaks down what’s changing, what’s still uncertain, and how employers can demonstrate strategic leadership, empathy, and action.

What the changes mean for employees

The OBBBA promises a “simplification” in federal loan repayment, but it also reflects a broader policy shift that puts greater financial responsibility on individual borrowers. For HR leaders, this nuance is critical. Fewer repayment options may reduce administrative complexity for the federal government, but the changes will also reduce flexibility for employees navigating financial hardship or career transitions. In this new landscape, “simplified” doesn’t always mean easier — and certainly not more affordable.

The changes carry several significant implications for employees with federal student loans:

Potential for higher payments and longer repayment timelines

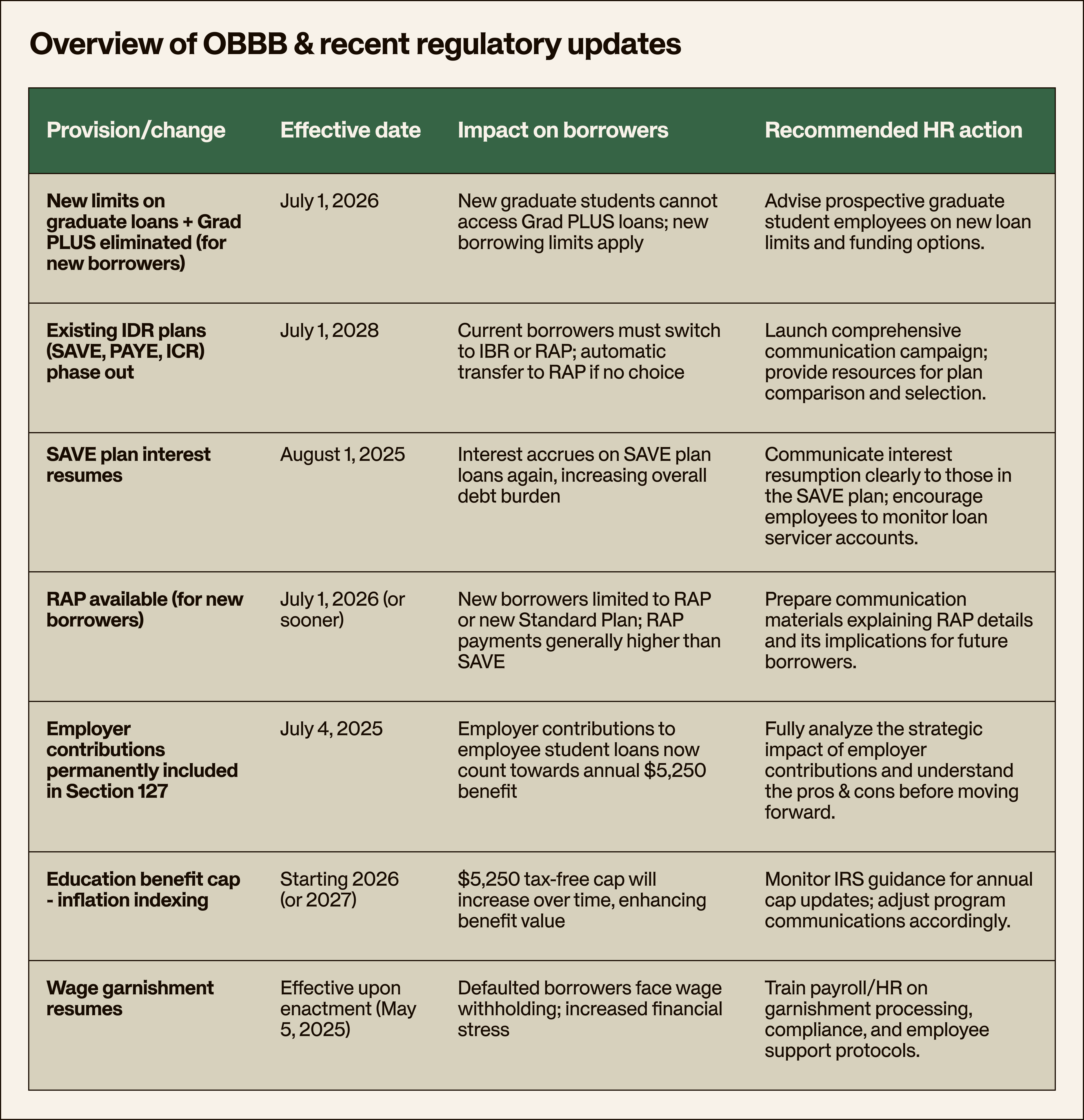

Many existing borrowers, particularly those who were benefiting from the lower payments of the Saving on a Valuable Education (SAVE) plan will likely face significantly higher monthly payments when they are required to transition to Income-Based Repayment (IBR) or the Repayment Assistance Plan (RAP) by July 1, 2028. The RAP plan also extends the forgiveness timeline to 30 years, a longer period compared with the 20 or 25 years under previous IBR plans.

Reduced access to federal loans for future studies

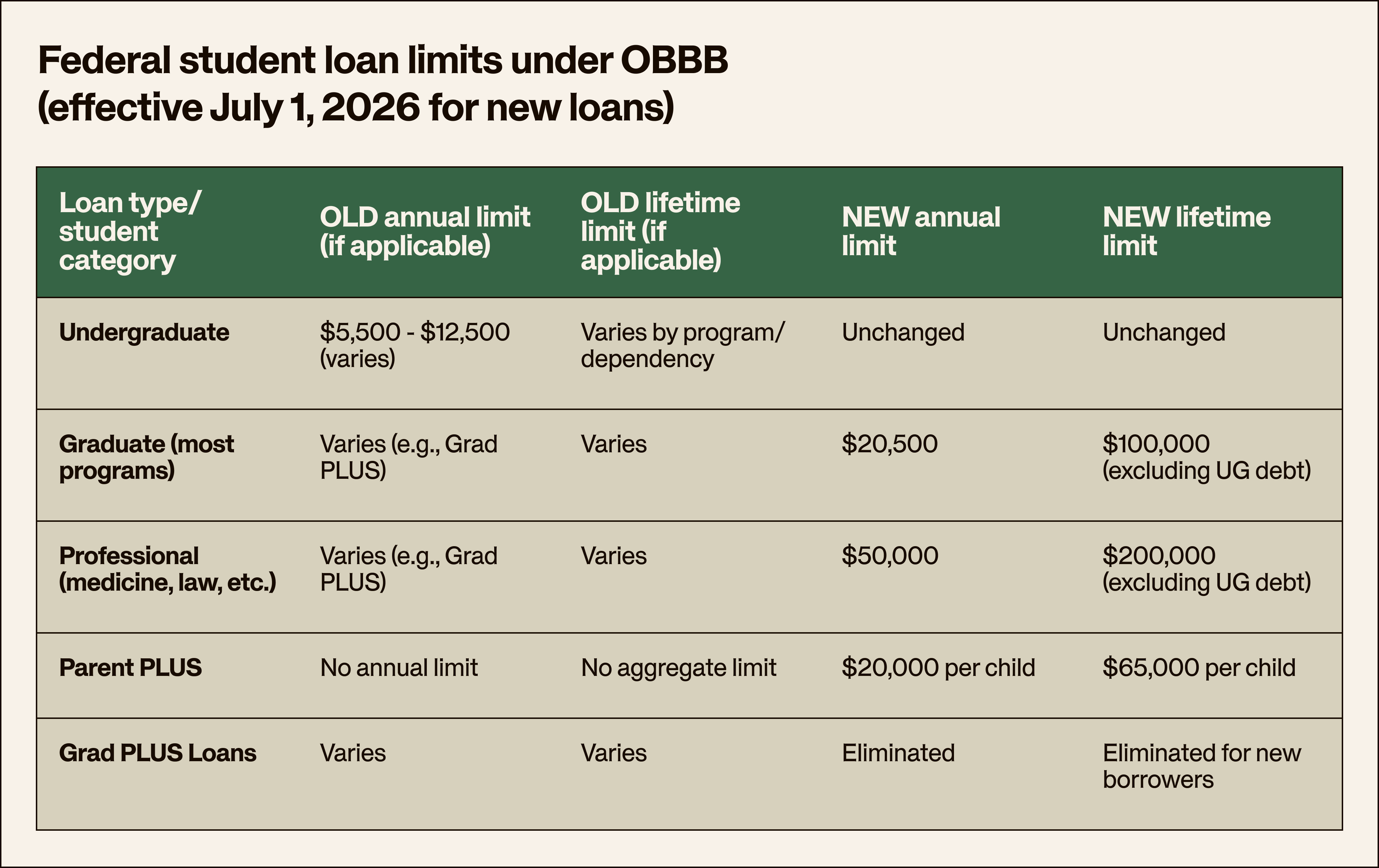

The new lower borrowing caps for graduate, professional, and Parent PLUS loans (which are federal loans that allow parents of dependent undergraduate students to borrow money to help pay for their child's college education), alongside the elimination of the Grad PLUS program (which was specifically designed to help graduate and professional students finance their education) for new borrowers, mean that future learners may find it more challenging to fully finance their education through federal loans alone. This change could necessitate seeking private loans, which often come with less flexible terms and higher interest rates, increasing their overall cost-of-education and debt burden.

Decreased borrower protections

Borrowers facing financial difficulties will find fewer options due to the elimination of unemployment deferment and economic hardship deferment, which currently allow borrowers to pause payments during financial difficulties. The silver lining is that borrowers are now able to rehabilitate defaulted loans (i.e., move a loan back into good standing) twice; previously borrowers had been limited to a single rehabilitation.

Wage garnishment

This past spring, the federal government restarted wage garnishment for individuals who have student loans in default. Based on several reports, up to five million borrowers may be in default by the end of this summer. This means the federal government may garnish paychecks by up to 15% for those employees who have fallen significantly behind in paying back their student loans.

Increased financial stress and its impact on the workplace

The shift to potentially higher monthly payments, longer repayment periods, and wage garnishments can lead to heightened financial stress for employees. But unfortunately the impact doesn’t stop there. Research indicates this stress often carries over into the workplace, reducing focus, driving up absenteeism, and accelerating turnover. A 2023 survey by PwC found that financially stressed employees are twice as likely to be looking for a new job, and one in three admitted that money worries have negatively affected their productivity. For employers, this means student debt is both a personal-finance issue and a performance and retention issue.

Critical deadlines for action

Employees with existing federal loans, especially those currently enrolled in SAVE, Pay As You Earn (PAYE), and Income-Contingent Repayment (ICR) face critical deadlines. They have a limited window, primarily until July 1, 2026 or July 1, 2028, to take specific actions to secure more favorable legacy repayment terms before these options are phased out and they are automatically switched to the RAP plan.

What the changes mean for employers

Employer student loan contributions

For employers, the OBBBA makes permanent the inclusion of tax-free employer student loan contributions that count towards the annual $5,250 cap in education benefits. Employers can opt to make contributions to an employee’s student loans, effectively helping them address the financial hardship of student debt. Now that these contributions are permanently part of the Section 127 tax exemption, this law change will solidify employer contributions as a new tool for recruitment, retention, and supporting employee financial well-being.

Employers should think carefully about the design of these programs and how they fit into their broader workforce strategy. Allowing employees to tap into their $5,250 annual benefit to help pay down debt can have a positive impact on retention and reduce financial stress. At the same time, however, the budget implications for these employer contributions can be significant, and the risk is that employees with no student debt may feel disenfranchised. At Guild, we have seen employers struggle with the budget impact from these contributions as it constrains future investments needed in education and skilling. It is critical for employers to fully understand the pros and cons of this benefit before jumping in.

Wage garnishment begins. Be prepared.

Federal wage garnishments for defaulted student loans have resumed. Loan holders can now order employers to withhold up to 15% of a borrower’s disposable pay to collect defaulted debt without requiring a court order. Employers receiving a valid federal student loan garnishment order have no legal authority to refuse it, and garnishments must begin with the next payroll cycle, without delay or negotiation.

This directly impacts employers, since processing these garnishments adds administrative burden to payroll and HR departments, requiring accurate calculations, legal prioritization of multiple garnishments, and comprehensive record-keeping.

Beyond the administrative aspect, increased defaults and garnishments cause financial distress among borrowers in your workforces — which, again, can lead to reduced productivity, increased absenteeism, and higher turnover rates. HR leaders need to prepare for this operational impact and proactively offer support.

Challenges for future healthcare professionals

New borrowing limits for students in professional graduate programs will likely increase the financial costs for future medical professionals. According to an analysis by the American Enterprise Institute, more than 40% of medical students borrow over the OBBBA’s $50,000 annual limit today. They will now need to turn to the private lending market, where rates and repayment terms are less borrower-friendly. This development has sparked concern in the medical profession. David Skorton, president and CEO of the Association of American Medical Colleges, has said these changes “will affect many prospective medical and other health professions students and worsen the nation’s persistent doctor shortage.”

For nonprofit healthcare organizations that leverage Public Service Loan Forgiveness (PSLF), the good news is that this federal program is mainly unchanged. However, there is one important update to note: PSLF is no longer available to those individuals in their medical residency programs. This, coupled with increased borrowing costs, may further contribute to future doctor shortages.

Staying ready in a shifting policy landscape

While the OBBBA is now law, many of its key provisions remain unsettled. The Department of Education has signaled that additional guidance is forthcoming, and the policy’s phased rollout means that its full scope will continue to evolve over time. For HR leaders, this presents an opportunity to lead with clarity by monitoring changes closely, preparing systems early, and anticipating questions before they arise.

There is also growing concern about the Education Department’s capacity to implement these changes at scale, particularly amid staffing constraints. Delays, clarifications, and policy shifts are likely. In this environment, HR teams can stay ahead by translating complexity into clarity for employees, adapting communication strategies in real time, and preparing internal processes to flex with future changes.

HR leadership opportunity

The immediate and near-term effective dates of various provisions, coupled with the potential for increased financial stress on many employees, create an urgent need for employers to understand and act on these changes. If employees remain uninformed or unable to navigate these new rules, they could find themselves in worsening financial situations.

This dynamic elevates HR’s role from a passive information provider to an active facilitator, ensuring employees have access to proper guidance to help them through critical, time-sensitive decisions. Proactive communication and the provision of robust resources are essential to prevent employee financial distress and maintain workforce engagement. Here are actions leaders can take to prepare their workforce for the change:

Understand the full impact of financial stress on your workforce.

This marks an important moment to assess not just the financial health of your employees, but how that stress may be affecting productivity, engagement, and retention across your organization. Student debt is often just one piece of a larger financial picture, and it can permeate other areas of work and wellbeing. Use surveys, focus groups, or listening sessions to uncover where support is most needed and how financial strain may be influencing performance, morale, or long-term workforce planning.

Consider third-party solutions to ensure employees receive professional guidance.

There are a number of solutions on the market that can provide the appropriate guidance, support, and operational requirements to enable an effective student loan benefit. When vetting these vendors, ensure they are qualified to provide financial guidance to your employees and that they support the strategic alignment of a student loan benefit policy with your broader workforce strategy.

Carefully analyze the pros and cons of employer contributions.

Before launching a student loan repayment benefit, take time to understand the short- and long-term implications for both your workforce strategy and your budgets. Student-loan contributions can be a highly effective way to attract and retain talent — especially among younger or mid-career employees — but if not designed thoughtfully, they can create perceived inequities across your workforce. For example, employees who already paid off their loans or didn’t attend college may see the benefit as exclusionary to them. A well-crafted program should align with your broader talent goals and be paired with clear communication to avoid unintended tension or disengagement.

Prepare to effectively manage wage garnishment.

Ensure your HR and payroll teams thoroughly understand the legal and operational requirements to manage wage garnishments. This includes accurate calculations, proper prioritization of multiple garnishments, and maintaining employee confidentiality throughout the process.

HR leaders do not need to tackle these challenges alone. Guild offers comprehensive student loan benefit solutions through our longstanding partnership with Candidly, the leading student debt benefit platform. Like Guild, Candidly is highly engaged on Capitol Hill and has a good FAQ that provides a full overview of the changes from the OBBBA.

Guild welcomes any opportunity to share our experience in this space and help employers make the best decision for their strategy and their workforce. We continue to monitor these changes and are committed to ensuring you and your employees receive the best guidance possible in this challenging environment.